We forgive you. Your City Attorney robbed you of your opportunity to discover that the impossible exists. We, DAVID EUGENE ROZIER, SR., KAREN MICHELE ROZIER and DAVID EUGENE ROZIER, JR aka David Bear Rozier, exist.

The man you convicted as David Rozier actually built our 4,206 square foot home from foundation to finish with no outside labor. In our ad we said it cost us less than $35 per sq/ft. It actually cost us slightly over $29 per sq/ft, but we didn’t want to brag. The City Attorney deprived you of your right to listen to our neighbors, many of whom were willing to drive to Los Angeles to vouch for David’s credibility. They were willing to testify as to how they watched him tear down the old house before we moved in and then watched him rebuild alone. He is a very talented degreed unlicensed architect. His court-appointed attorney he met at trial failed to subpoena his witnesses or introduce his evidence. You and your tax dollars were used to convict an innocent man.

I have a degree in electrical engineering from Carnegie Mellon University (CMU) a masters also from CMU – an MS Industrial Administration, the equivalent of an MBA but with a concentration in manufacturing, I also have a Masters in Public Administration from Harvard University. I was admitted into their doctoral program with full tuition plus stipend. Harvard paid me to attend their university. Your City Attorney had full knowledge of my significant and documented work with IBM Corporation, Hughes Aircraft, Raytheon Systems Company and the Department of Defense. As you recall, he objected to my education, credentials, and publications being admitted into evidence, especically the evidence that I was briefly a Navy missile engineer and was selected as “Chief Engineer, Air-to-Ground Missiles, after being recommended by the Senior Engineer who trained me for five years. The Navy felt I was qualified to be “chief rocket scientist in charge of other rocket scientists”, but thanks to your indifference, I am scheduled to be sentenced to jail. You had before you a female Harvard doctoral candidate Navy rocket scientist and the City Attorney convinced you that I was a “Black con artist from a Detroit ghetto”. I have never been to Detroit, but you fell for it because all you saw was what the City Attorney and our court-appointed attorneys showed you. Your City Attorney knew that I was born and raised in Baltimore because he verified it back in 2011 when we were represented by the Cochran Firm. Didn’t you even wonder (during your brief deliberation) why my information was excluded and I was silenced? Your City Attorney had this evidence but excluded it, playing on your prejudices and ignorance. You and your tax dollars were used to convict an innocent woman.

The City Attorney knew he had no reason or right to pursue the case, but he also knew that prejudice and bias, as well as just common sense, would play in his favor.

One man buili a million dollar home alone on the cheap.

A Black female Harvard rocket scientist.

A brain damaged and cerebral palsied kid that clearly looks and acts healthy.

The reason why the “con” was believable is because it is true; we are who we say we are, did what we say we did, and were fully qualified and prepared to deliver what we promised to and in fact did, deliver. As for our son David Bear, the one you essentially sentenced to Foster Care (had it not been for my preventative measures) he really does have cerebral palsy. I know you feel that we created an elaborate rouse in order to elicit sympathy from potential victims, but your City Attorney has seen the medical records. Our son was in court to testify about the two brain surgeries he had at the time of the handwritten contract. Didn’t it strike you as odd that no one focused on that one contract being handwritten? Of course not! You deliberated for less than 20-minutes! May you learn to question your instincts.

David Bear was born weighing 744 grams (1.5 pounds). According to his doctor and medical charts, information that your City Attorney hid from you, he had:

(1) an open artery between his heart and lungs causing bleeding into his lung, requiring him to be transferred from Newport Beach (his birth place) to CHOC for surgery to close the artery, “patent ductus arterious”, aka “heart/lung surgery”.

(2) brain damage covering around 75% of both sides of his brain; three brain shunt surgeries;

(3) retinopathy of prematurity, the leading condition of blindness; His eyes have self-corrected twice, resulting in him no longer being eligible for Braille services as of May 28, 2013. This is his first official Christmas with sight, and thanks to the twelve of you, he now knows ugliness;

(4) Jaundice;

(5) Double hernia, requiring double hernia surgery.

When we brought him home from the hospital, the Drumonds were his first visitors. We were shocked when the witness Drummond denied knowing us initially. The City Attorney is such a shrewd man, he also managed to get Drummond on the stands despite Drummond changing his story three times during the investigation. What are we to expect from a man working on his sixth marriage. Oops, his character isn’t somehow relevant, yet he is allowed to testify about another’s character. Are you comfortable living in that world?

The 15-year old boy the twelve of you feel should be in Foster Care was on oxygen until approximately age two. He has saved a life, and was honored for his contribution. The reason why David Sr. hasn’t sat for the architect license (which according to the court is “irrelevant”) was because he quit his job with Tagfront Architects to build our 4,206 square foot home and to heal our son. For that, you elected to send him to jail. Since you didn’t look at any of the evidence during your brief deliberation, that fact may not have mattered, but this would be a less forgiving letter.

You have seen our son. I would love for you to come see the house that he built, by himself, for his son. According to Zillow.com the day you convicted us, it was worth over $1.1 million. I am more than willing to share all the receipts plus the spreadsheets of the costs. We were planning to make a video and make it public, but you decided that we should spend six months in jail instead.

We did not need to lie about our accomplishments or affiliations because we are who we say we are and we absolutely have done everything we said we did. We had an office in Mexico before we met Ms. Ekstrand, and the land contracts, business contracts, rental agreements, utility statements, and bank account statements were likewise excluded from evidence. [I hope that those of your who proudly boasted of sitting on previous juries are seriously reconsidering your previous verdicts.] The City Attorney knows that we invested more than $200,000 of our own money plus another $50,000 of money from family in Mexico long before we met Ms. Ekstrand. I know the City Attorney made the $100,000 appear to be a huge amount for the two Defendants you convicted on paper, but you did not convict the two people that appeared before you in court.

The City Attorney knows we are not con artists but are in fact credible. We were used to sentence a Black man to seven years in prison plus years probation on fifteen felony counts. We lost $55,000 on his deal and he was charged with two felonies. Didn’t you wonder why the City Attorney would charge an alleged $100,000-theft as a misdemeanor? I pray thay your children and grandchildren are better educated.

Given that you now know that the people who appeared before you are competent and qualified, that the man that appeared before you did build a 4,206 square foot home for less than $35 per square foot, and that the boy you observed does have cerebral palsy, do you still feel that we are “not credible” and “con artists” or do you feel that you were used andcheated by the City Attorney?

We even did the things the City Attorney didn’t say, such as we asked Ms. Ekstrand twice in writing to come get her final package, asked her lawyer to come get it, and even mailed it to her. She admitted to your City Investigator that she returned the final package because she just didn’t want it. That was after she sued us for $1.4 million, and before she paid cash for her daughter to attend law school for three years. According to her emails which the City Attorney was able to exclude, she didn’t want her daughter to take out any student loans. She wanted her daughter to be able to marry a wealthy white man like she did, so her grandchildren wouldn’t look Asian, or using her own word, “ugly”. If you go to her home and look at the pictures, you will see what I saw — a child that was forced to dye her hair and wear colored contacts so she wouldn’t look “so Asian”, as Ms. Ekstrand described to me. I wasn’t allowed to defend that statement on the stand, though you should have been able to see that I was more than anxious to speak. I could tell you were all offended. Such a shrewd liar, that City Attorney. I do not forgive him.

You were entrusted with our lives and the lives of our son, family, friends associates and communities yet you were so cavalier that you didn’t even look at all the evidence.

I don’t hate you. I pity you. I pray that you accept that you can be more than you presently are and then try to be more. At least three of you should be permanently barred from jury duty, and I will make that recommendation privately. One of you should lose your job. I’m sure Ms. Ekstrand is enjoying her time, if not at her Hollywood home, then at her San Bernardino property, her Las Vegas property, or even perhaps overseas with her husband at their estate; she is quite wealthy you know, or did the City Attorney hide this from you as well? That’s right. He lied. He outright lied to you when he portrayed her as an ignorant elderly lady who invested her life savings and was conned by two liars. She is a wealthy, connected land owner who just used you to convict and potentially incarcerate three talented, honest, Black people. I want to hate you, but I am saddened that you still harbor such hate and malice that you can’t open your eyes to the possibility of greatness. How very sad your lives must be. Please know that goodness, greatness, healing and love exist. We – David Eugene Rozier, Sr, Karen Michele Rozier, and David Eugene Rozier, Jr. forgive you.

The simple fact is that the City Attorney hid the truth from you, our court-appointed lawyers were unprepared for trial, and the judge was more interested in protecting her perfect record of getting cases to jury on target than respecting two Defendants’ constitutional protections. We wish you take from this experience that God has provided us all with abundance and each with our own talents. During the Christmas, Kwanza, and Holiday Season, may you reject the stereotypes that limit us all and embrace the impossibility of Peace on Earth, Good Will Towards Men. Just like the government lied to you about our being able to exist, they have lied to you about war being a necessary condition. I pray that you learn from this experience.

Merry Christmas. Happy Kwanza Peace Be With You.

Karen M. Rozier, Peace Advocate

David E. Rozier, Sr., Master Builder

David E. Rozier, Jr., Miracle

Stay tuned for Part II: “My Court-Appointed Attorney’s Ties to Bank of America and How this Fraudulent Conviction Helps Bank of America in the case of Rozier v. Bank of America, Scheduled for Trial on April 28, 2013.”_____________________________

Letters of outrage can be sent to the City Attorney at: Mr. Mike Feuer

The Office of The City Attorney

800 City Hall East

200 N. Main Street

Los Angeles, CA 90012

Re: Prosecutor Misconduct of Keith de la Rosa

____________________

Mr. Ronald L. Brown, Public Defender

Law Office of the Los Angeles City County

210 West Temple St. 19th Floor

Los Angeles, CA 90012 (213) 974-2811

Subject: Gross Negligence of Chris Scherer

When I first named this blog I didn’t realize how prophetic the title would end up being; because now again, I have to live with a decision I made. Without going into excruciating detail, I will state that we were taken out by a bad strategy, in a premature case evaluation, on a case that had documented fraud. I didn’t realize that when a crime was committed that you could have three blokes with two minutes of time with your case come in and make such an opinion and then threaten sanctions against the aggrieved party should they not go along with a forced game of Russian roulette. However, this is fine. I will accept what I have to accept; but then again, I am not going to accept that which I don’t have to. This was one battle and there are still a few more to come. I still have all the evidence and I have freedom of speech.

When I first named this blog I didn’t realize how prophetic the title would end up being; because now again, I have to live with a decision I made. Without going into excruciating detail, I will state that we were taken out by a bad strategy, in a premature case evaluation, on a case that had documented fraud. I didn’t realize that when a crime was committed that you could have three blokes with two minutes of time with your case come in and make such an opinion and then threaten sanctions against the aggrieved party should they not go along with a forced game of Russian roulette. However, this is fine. I will accept what I have to accept; but then again, I am not going to accept that which I don’t have to. This was one battle and there are still a few more to come. I still have all the evidence and I have freedom of speech.

I sit here daily, listening to my heart and try to discern what I need to take and give from this whole experience. The one thing that stands out to me most is the fact that these stories of fraud, even though plastered throughout our court systems; are not really educating those that need the education the most. That education needs to be brought to those that are actually on the front-line of being able to stop these types of frauds from occurring; the people that are in charge of our land records offices across this country.

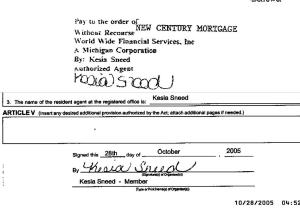

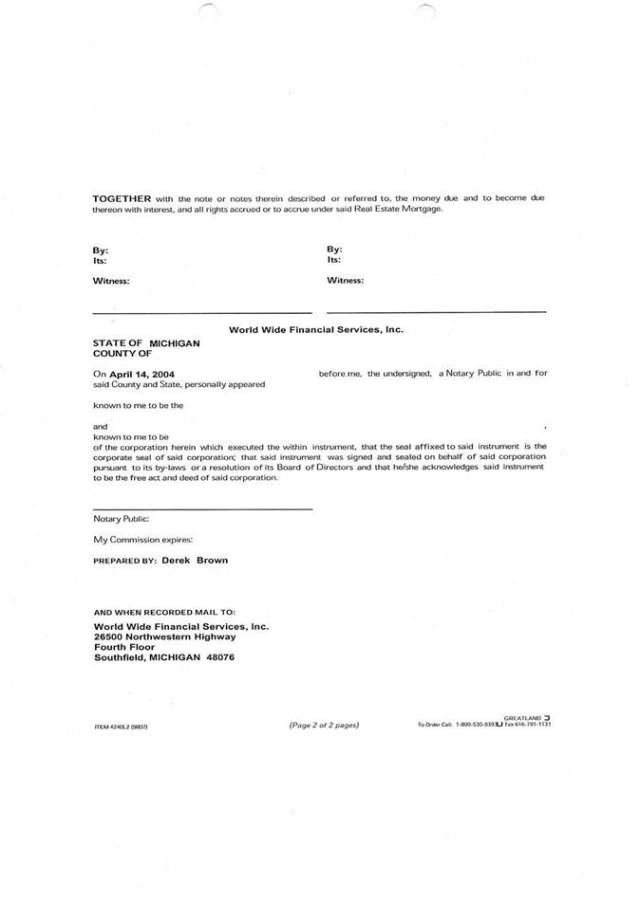

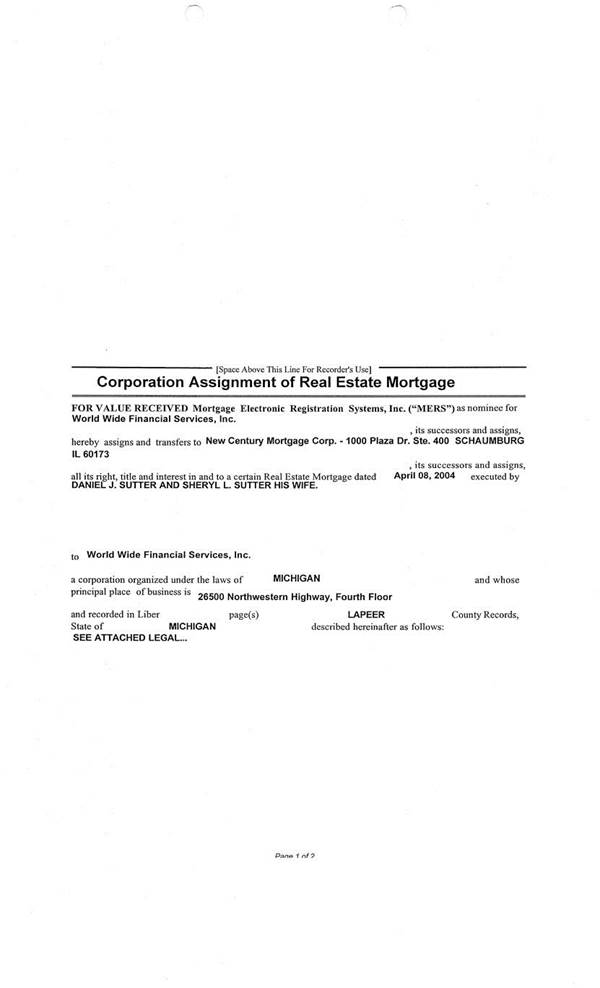

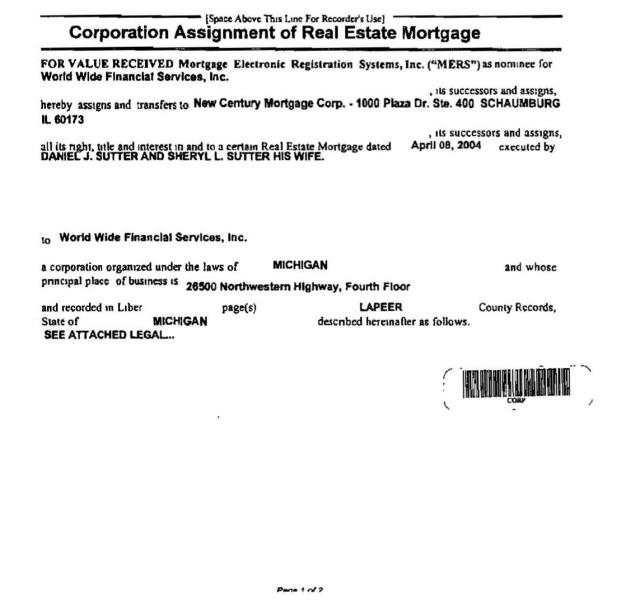

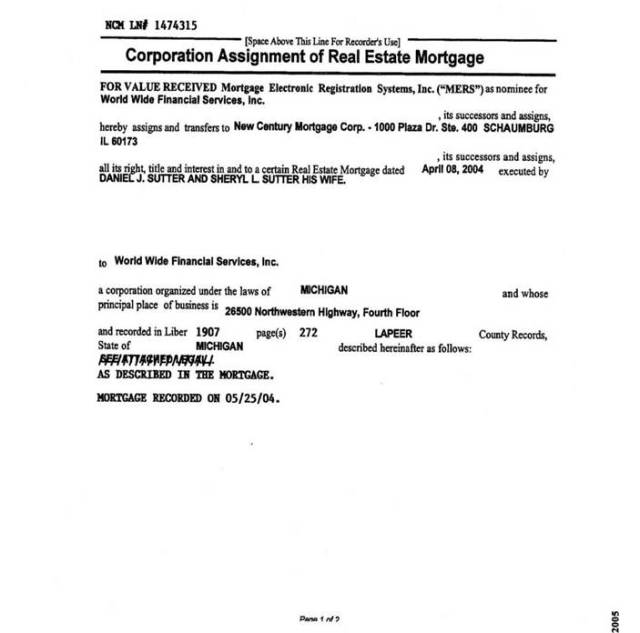

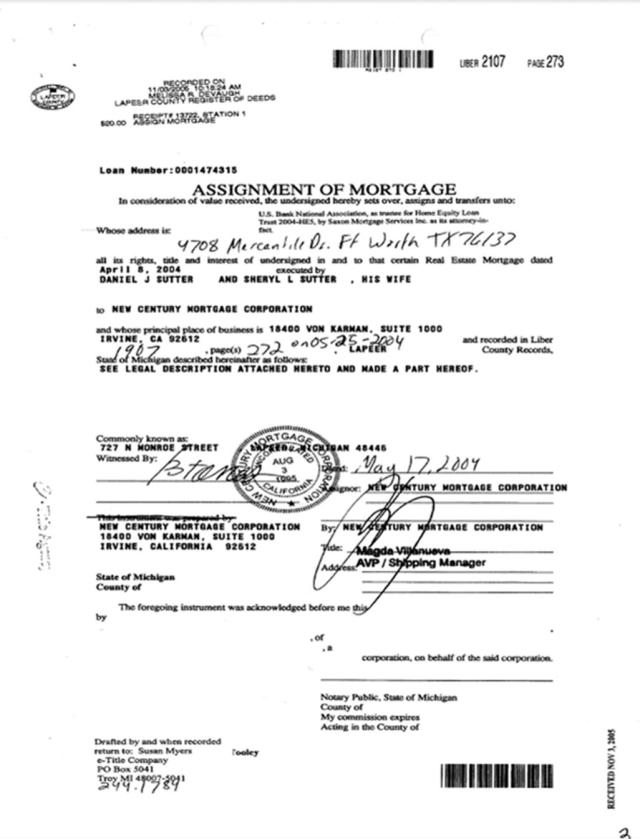

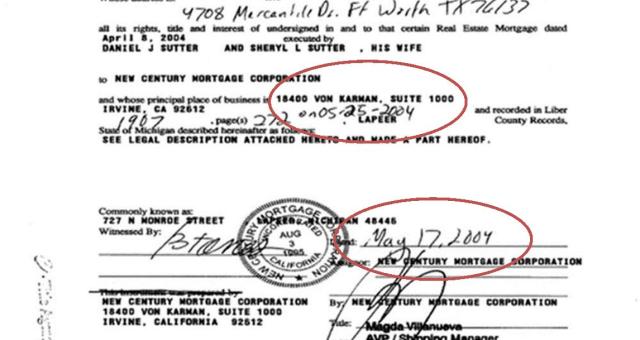

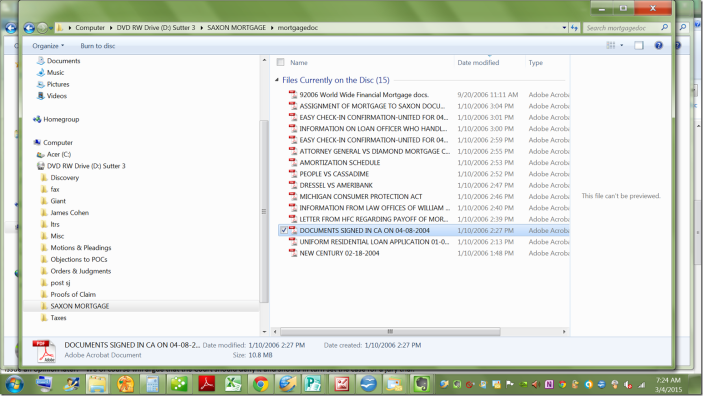

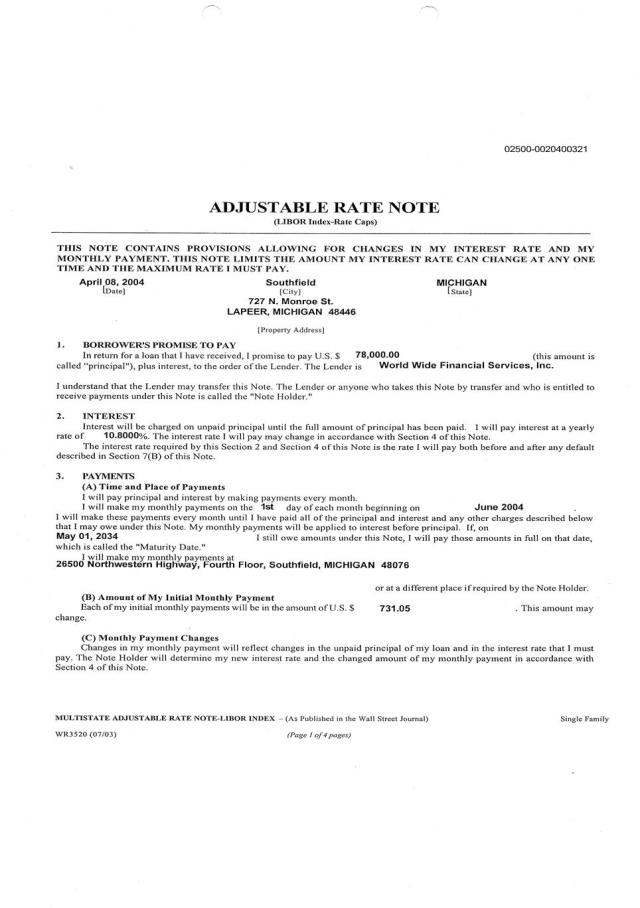

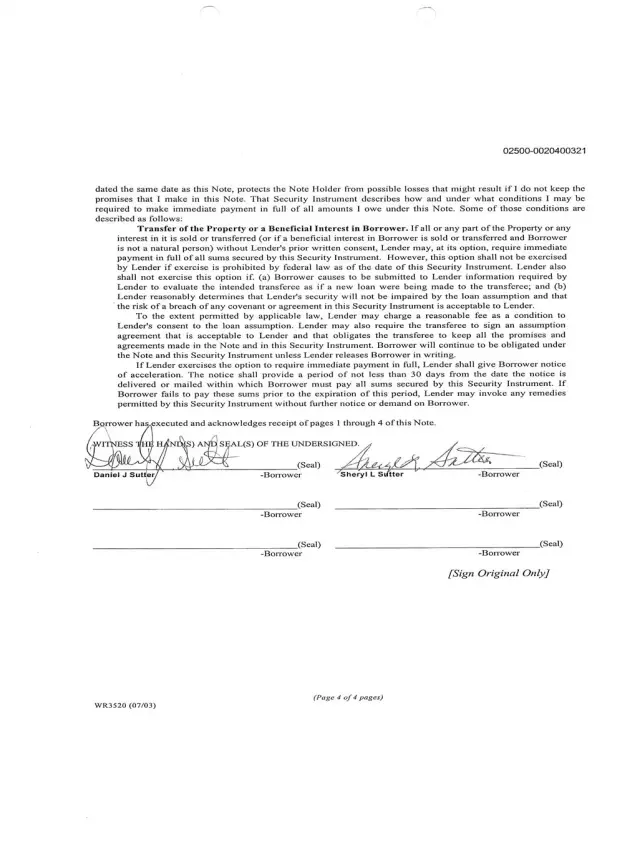

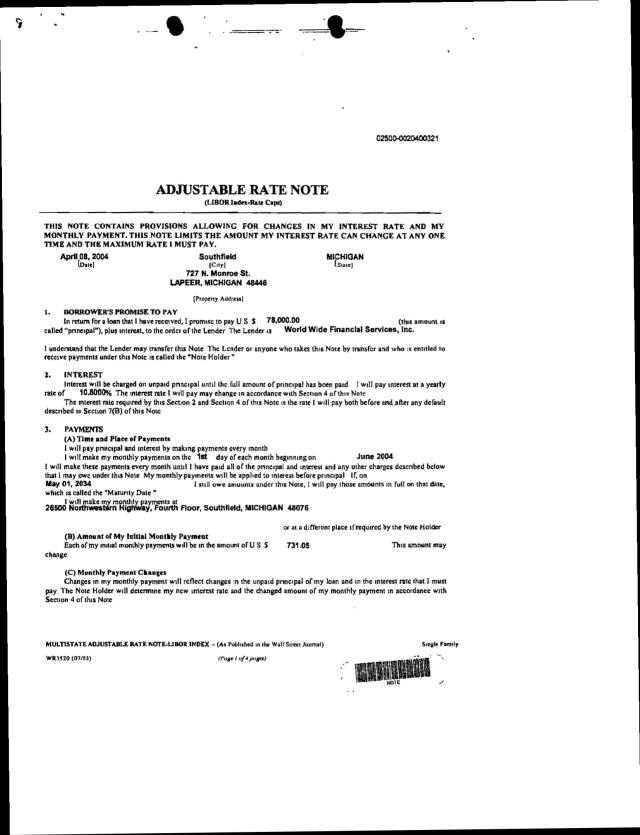

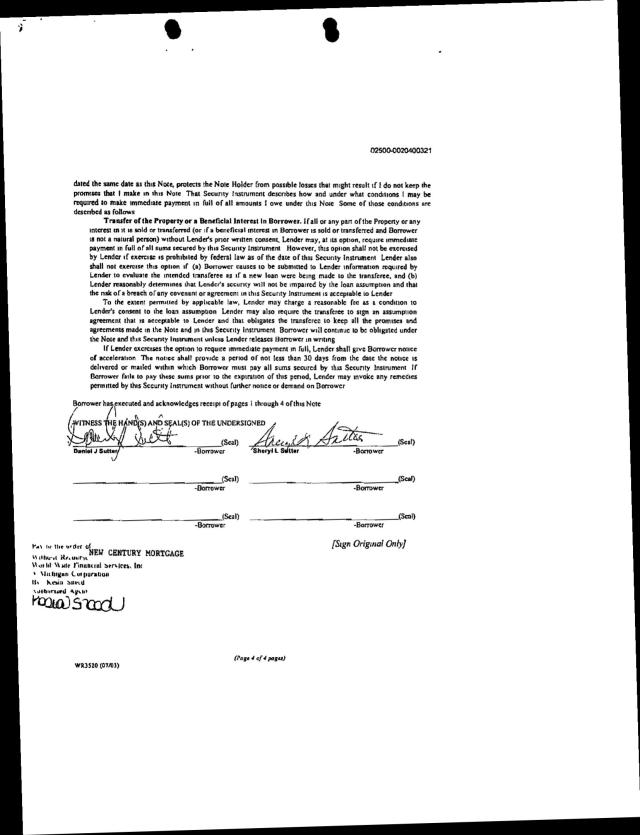

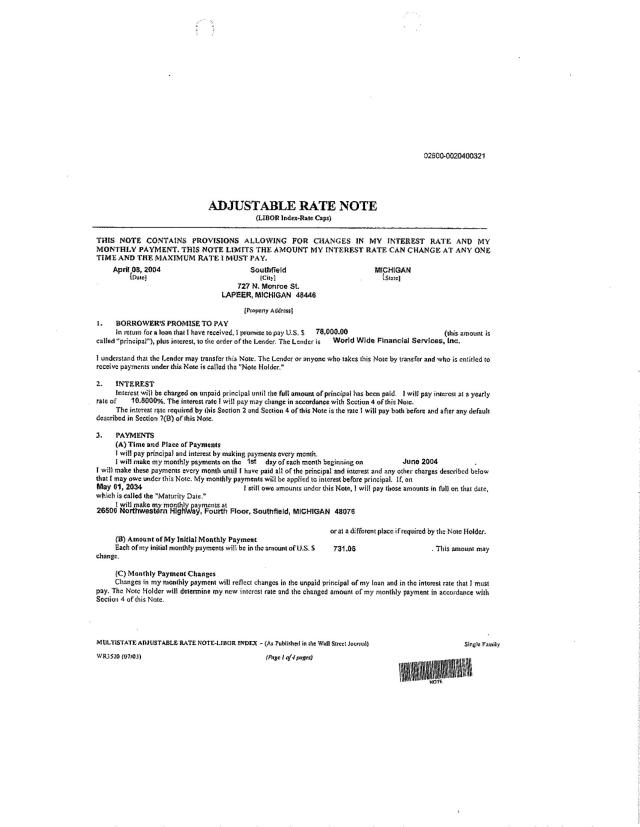

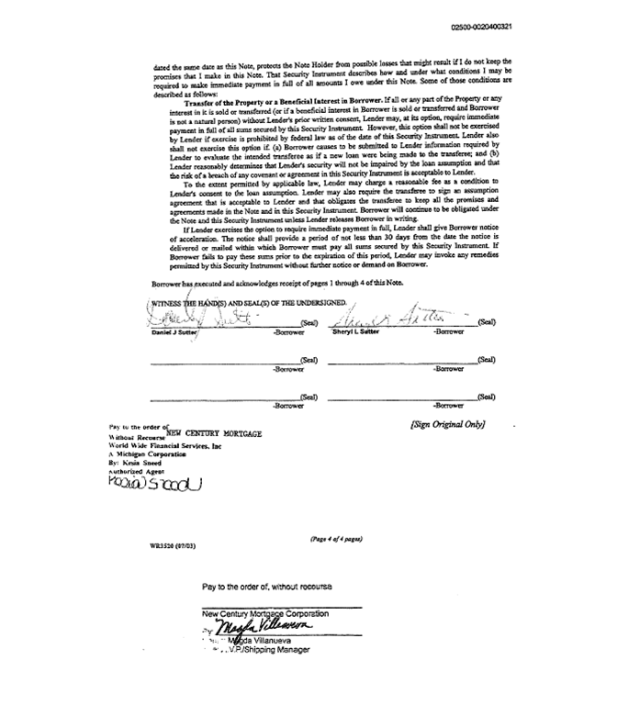

I sit here daily, listening to my heart and try to discern what I need to take and give from this whole experience. The one thing that stands out to me most is the fact that these stories of fraud, even though plastered throughout our court systems; are not really educating those that need the education the most. That education needs to be brought to those that are actually on the front-line of being able to stop these types of frauds from occurring; the people that are in charge of our land records offices across this country. The lawyers for the bank in our case had a choice when they discovered, in 2006, that they held a forged mortgage and did not have the paperwork to back up their claims. There were legal recourses for these attorneys’ to take that would have been, at least an attempt at doing things the right way; yet, instead, they made a conscious decision to follow in the predecessors footsteps and commit further frauds against already victimized homeowners.

The lawyers for the bank in our case had a choice when they discovered, in 2006, that they held a forged mortgage and did not have the paperwork to back up their claims. There were legal recourses for these attorneys’ to take that would have been, at least an attempt at doing things the right way; yet, instead, they made a conscious decision to follow in the predecessors footsteps and commit further frauds against already victimized homeowners.

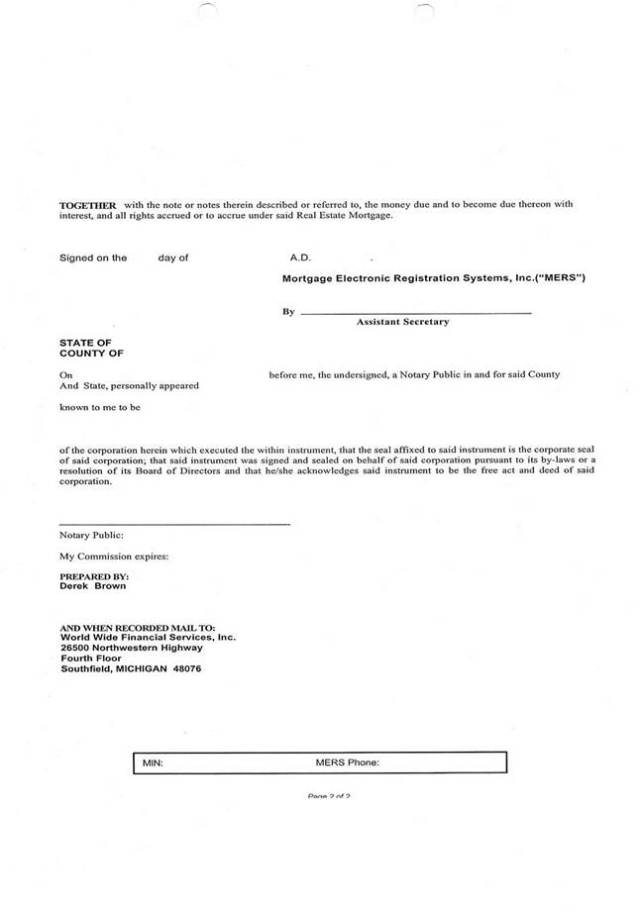

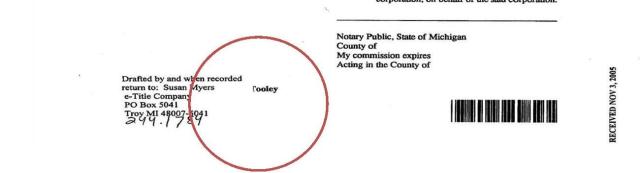

My last is a general observation of the document as well. If a document has a place where it is supposed to be notarized; why are our land records so full of inaccurate and improperly certified documents that involve the land of it’s citizens?

My last is a general observation of the document as well. If a document has a place where it is supposed to be notarized; why are our land records so full of inaccurate and improperly certified documents that involve the land of it’s citizens?

It has been a while since I have shared my thoughts with all of you that are fighting the good fight against the crimes that have been committed against you. Our own court battle with Ocwen has heated up and we are in the midst of our final battle and it should be epic; however, that is not the purpose of the post today. That story will have to wait for a little bit longer.

It has been a while since I have shared my thoughts with all of you that are fighting the good fight against the crimes that have been committed against you. Our own court battle with Ocwen has heated up and we are in the midst of our final battle and it should be epic; however, that is not the purpose of the post today. That story will have to wait for a little bit longer. I can now offer you proof positive that the bank can be beat. As most of you whom have followed this blog over the past couple years are aware, we won an avoided mortgage against the bank in the 6th US Circuit Court in January of 2012. Through many trials and tribulations we were finally able to secure excellent legal representation and pursue clearing our title. During this journey, the bank, who had no interest in our property, continued to do business as usual, insuring our home and paying the taxes. In April of 2013, I decided to challenge this forced insurance based on my belief that them having insurance on our home was likened to me having insurance on my neighbor’s home, of which I have no interest in. In January 2014 we deposited a portion of the insurance proceeds into our bank account and will now be able to fix our roof!

I can now offer you proof positive that the bank can be beat. As most of you whom have followed this blog over the past couple years are aware, we won an avoided mortgage against the bank in the 6th US Circuit Court in January of 2012. Through many trials and tribulations we were finally able to secure excellent legal representation and pursue clearing our title. During this journey, the bank, who had no interest in our property, continued to do business as usual, insuring our home and paying the taxes. In April of 2013, I decided to challenge this forced insurance based on my belief that them having insurance on our home was likened to me having insurance on my neighbor’s home, of which I have no interest in. In January 2014 we deposited a portion of the insurance proceeds into our bank account and will now be able to fix our roof! As you may have noticed, I have been off the radar for the past couple of months. Our attorney advised that I stay away from possibly giving the bank any ammunition that could be used against us. Although, I do believe, had he read my blog, he would have realized that this is not the track that I have taken in my writings. My goal, as these words evolve, is aimed at helping follow mortgage fraud victims get through the emotional trials that come with taking on the challenge of fighting the bank. My understanding of the law and what it should mean has been skewed by the process and therefore not where my strength lies. My strong suit emerged from a soul screaming for relief. Only when I silenced the screams was I able to hear the message.

As you may have noticed, I have been off the radar for the past couple of months. Our attorney advised that I stay away from possibly giving the bank any ammunition that could be used against us. Although, I do believe, had he read my blog, he would have realized that this is not the track that I have taken in my writings. My goal, as these words evolve, is aimed at helping follow mortgage fraud victims get through the emotional trials that come with taking on the challenge of fighting the bank. My understanding of the law and what it should mean has been skewed by the process and therefore not where my strength lies. My strong suit emerged from a soul screaming for relief. Only when I silenced the screams was I able to hear the message.